I arrived a tad late. I believe I missed about three songs from Seamonsters. They're a band from NY and Washington DC. The lead singer mentioned their bass player and how a number of her family members were in the audience. There was a guy taping the whole set who I figured was either her father or uncle. They had a good set. I'd check them out again if they were based out here in Los Angeles.

Next up was a band called Venus Illuminato. First thing I noticed, a violinist (if this individual comes across this blog, I apologize if you really were playing a viola or other string instrument) was in the band and since I'm partial to strings in bands I was hooked. Next, I saw some incense at the front of the stage, which implied to me that this band was going to be a bit unique. And finally, one couldn't help but notice the bevy of beauties that stood around the stage, some with faces painted. A guy has to stick around for that. (If you're going to be a male-lead-singer band with the word Venus in your band name you better have female fans.) What about the band? They're great. I'd head out to catch one of their sets. I believe they had a set list of six, but played for 30 minutes plus. Long, lovely drawn out songs.

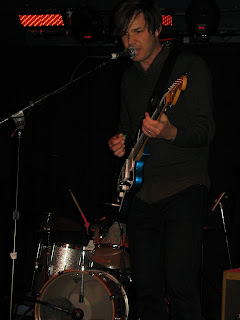

The final band of the night was The Muddy Reds. I almost left to go catch Mere Mortals' final night at Spaceland, but since the first two bands were so awesome, I decided to stick around for the last band of the night. They were obviously friends with Venus Illuminato, because a number of the Venus Illuminato fans were dancing away and talking with The Muddy Reds guys. In fact, someone called the sister of one of the band members and handed the phone over. And . . . the sister lived in New York, if I heard correctly, which means it was around 3 a.m. out there.

Update January 7: See comment that clarifies the connection between The Muddy Reds and Venus Illuminato.